In this insurance marketing guide, you will find information and tips on how to develop a successful insurance marketing strategy online. We have years of experience running successful digital marketing campaigns for insurance agencies and know exactly what to do to take your digital marketing to the next level.

We will also take a look at what the majority of insurance agencies are doing right and what they are doing wrong, and discuss how to make improvements.

Ready to step up your digital marketing game? Read on!

The Importance Of Digital Marketing For Insurance Agencies

Water. Food. Insurance. What do these three things have in common, you may ask? Things that people will always need (at least for the foreseeable future). Sure, water and food are necessary to live, but does that mean they aren’t being marketed? Absolutely not. In 2014, Nestle alone spent close to $5 million on advertising their Pure Life brand.

$5 million on advertising, for water. In no way are we suggesting your insurance agency needs to go and allocate that amount of money towards a marketing budget. However, we are contending that the data highlights the importance of marketing, regardless of the industry.

More than 70% of consumers receive quotes online before purchasing an insurance policy.

The first concept of marketing, which emphasized sales and advertising, can be traced all the way back to the sixteenth century.

Needless to say, marketing techniques and platforms on which we market is always in a state of constant evolution. There are prominent milestones throughout the course of history that can be attributed to the shift in the lucrative atmosphere that is marketing. Milestones such as the commercialization of radio around 1900 or the color television in the 1950s significantly contributed to the shift in the evolution of marketing. As you may have guessed, this presently leaves us in the milestone of the internet.

The ability to adapt to new technologies and atmospheres is the foundation to consistent growth and success. Now ask yourself, has your insurance agency followed the same trajectory? For most of you reading this, the answer is probably no – and don’t worry, you’re not alone.

Popular Goals For Insurance Marketing Campaigns

Let’s start by defining some of the most popular goals that insurance agencies have when starting a marketing campaign.

As you may know, insurance marketing campaigns are designed to grow a business. However, there are a wide range of metrics that can be tracked and goals that can be established during a campaign. If you set clearly-defined goals and metrics during an insurance marketing campaign, you are more likely to see streamlined results. Here are some of the most popular goals for insurance marketing campaigns that your agency can base its own marketing goals off of.

Rise In Brand Awareness

Though it may seem obvious, potential clients cannot interact with or reach out to your brand if they do not know about it. A marketing campaign with SEO can connect your agency to consumers who may not have otherwise discovered you. Thus, the majority of agencies that invest in marketing hope to see a rise in website traffic, which results in increased brand awareness. As you can see in Figure 1.1 below, our client Business Benefits Group (BBG Broker) has experienced a steady increase in Google searches for their brand alone.

Figure 1.1

- Brand Search Queries

Steady Flow Of Qualified Leads

What good is a marketing campaign that does not improve leads? The main focus of your insurance agency or brokerage is most likely to expand its book of clients. If individuals are not frequently calling your sales number, you could risk losing profitability. Therefore, most agencies that employ a marketing campaign look to receive a steady increase in qualified leads. Figures 1.2, 1.3 & 1.4 show the growth of qualified leads (per month) we have generated for BBG Broker over a 3 year period.

Figure 1.2

-

Qualified Leads In 2017

Figure 1.3

-

Qualified Leads In 2018

Figure 1.4

-

Qualified Leads In 2019

Increase In Ability To Cross-Sell

Cross-selling is an important technique in the insurance industry. An individual who purchased a policy from your agency is much more likely to buy another policy than one who has never heard of your agency before. Because of this, the majority of agencies who invest in an insurance marketing campaign are aiming to not only expand their book of clients, but also increase average profitability from each customer.

Biggest Mistakes Insurance Agencies Make With Digital Marketing

In this section, we will review some of the biggest mistakes insurance agencies make with their marketing campaigns.

We all know this – digital marketing is proven to work. That said, it will not be nearly as effective if your agency is not using proper guidelines and methods. There are plenty of mistakes insurance agencies often make when attempting to perform a digital marketing strategy. Here are the six biggest mistakes an agency can make that will significantly decrease a digital marketing campaign’s results.

1. Utilizing Marketing As A Secondary Role

One of the biggest, yet most common mistakes insurance agencies often make is utilizing employees (generally sales staff) to perform marketing as their secondary role. While sales staff is good for making outbound connections, they are not trained to perform inbound marketing, whereas a full-time marketer can handle both.

Most agencies also do not realize their website is their most cost-effective sales asset and is also a part of their sales team. The sales department will have a much better time closing business using the website. 321 Web Marketing recommends hiring one in-house marketer, as well as a team of third party marketers to create the website and assist and collaborate with the in-house employee.

2. Not Having Control Or Ownership Over Their Domain

Some insurance agencies may think that domain control/ownership is not a big deal. However, would you want a third party organization to be responsible for managing and protecting your domain? Of course not! By owning your domain, your agency is essentially free to do whatever you want with it (and is not locked into a marketing contract for X months). Additionally, when you have control over your domain name, you are given access to features such as creating unique email addresses for employees and departments.

We like to use this tool to check for domain ownership here. Try it out!

3. Not Using Market Research To Drive Decisions

Think about it – your insurance agency most likely developed insurance packages based on better versions of existing policies in the industry. If you agree with this statement, then why would you not instruct your agency to do the same when making marketing decisions? Conducting proper keyword research and seeing how other insurance agencies and brokerages market their brand is essential to developing a winning marketing strategy.

4. Creating Duplicate Website Content

No, it is not good to create one piece of content and slap different industry names or locations onto it. Your insurance agency should not treat its content as a game of Mad Libs, as Google can pick up on this and will lower your website’s rankings. Spending the time to create unique content for each industry or location (or whatever the case) will both improve your SEO and show potential customers that your organization is committed to quality work.

We like to use this tool to check for duplicate content. Try it out!

5. Having Sales Staff Create Content

Going back to the point of sales staff conducting marketing, it is never a good idea for them to create sales collateral, especially website content. Your sales team may know how to close business well, but they generally work best with tools that are provided to them. You should not have them attempt to create these tools themselves as they generally do not speak in layman’s terms. An important component of sales collateral is developing content that anyone who does not understand the business can understand (hence making it easy to close business with).

6. Not Performing A Link Building Strategy

Link building is an integral part of gaining domain authority, and in some cases, establishing relationships with other businesses. Sure, your agency may not think it is worth the time and effort required – that is why third party marketing organizations exist. Without link building, your agency’s website will not be able to rank properly for specific searches in the SERPs.

Red Flags That Indicate Your Insurance Marketing Isn’t Working

Unsure whether your marketing campaign is truly working or not? Read this section to identify and avoid costly mistakes.

So you’ve been performing digital marketing for your insurance agency – great! But, how do you truly know if you are getting the results you should expect to be getting? Here are the top five red flags you should be looking for with your insurance marketing campaign.

7+ Months Of Marketing, 0 Leads

Digital marketing takes time, especially SEO. But if you’ve been engaging in digital marketing and/or SEO for at least a 7 months and have not seen any leads, it’s time to reevaluate your strategy.

Inability To Track Where Leads Are Coming From

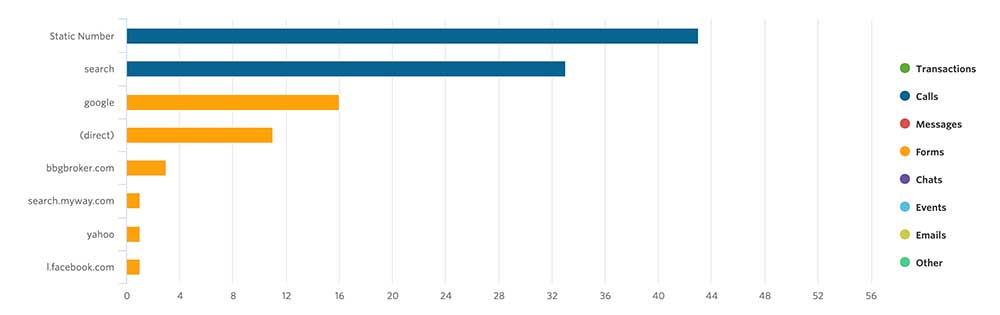

You can only improve the numbers you track. If your insurance agency is getting leads, but you are unsure as to where they are coming from, it’s time to start tracking. Implementing tracking solutions such as tracking phone numbers and web form tracking databases will give you a clear sense of when and how your agency is receiving its leads. Below is an example of BBG Broker’s lead data from our lead tracking system. This type of information should be easily available to you during your campaign. Figure 3.1 comes from 321’s lead tracking system and shows the breakdown of BBGs leads by source.

Figure 3.1

- Monthly Lead Sources

Leads Are Coming In, But None Of Them Are Qualified

Sure, an increase of leads means that your website is becoming more visible online. But after a few months if these leads are still not qualified, then you may be wasting your marketing budget targeting an audience that won’t turn into revenue.

Business Is ONLY Coming From Word Of Mouth

Word of mouth is a great way to increase your book of business. However, if your agency is performing digital marketing, then you should be getting an increased amount of business from users who have found your agency on the internet, not only by someone who referred them to you.

Your Website Does Not Make It Easier For Your Sales Team To Sell

Your website should act as a 24/7 salesperson. It should be easily found, navigable and include content that informs users about your insurance products so that your sales team can close deals more quickly and effectively.

Website Design For Insurance Agencies

A comprehensive look at how website design can help insurance agencies grow.

Most insurance agencies still have outdated websites, which severely impacts their overall visibility online and the conversion rate of traffic that enters their website. Most insurance agencies still utilize communication mediums such as television ads, newspapers and radio. Although these are still considered effective forms of marketing, no form of marketing is as beneficial as digital marketing, as the internet has become the main source for information and communication.

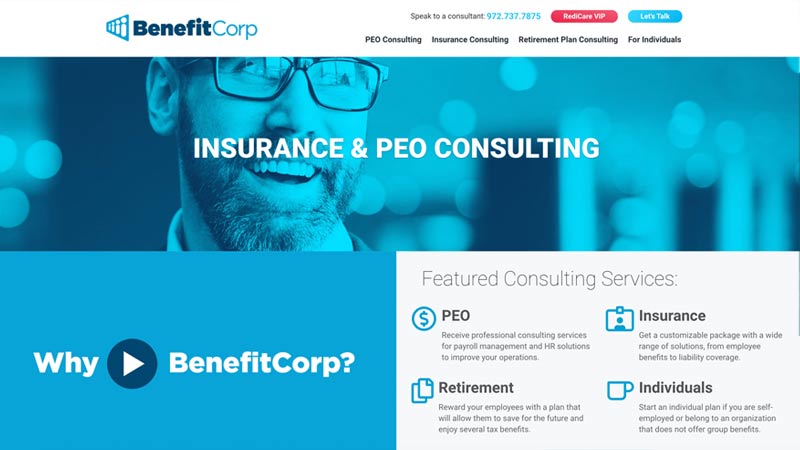

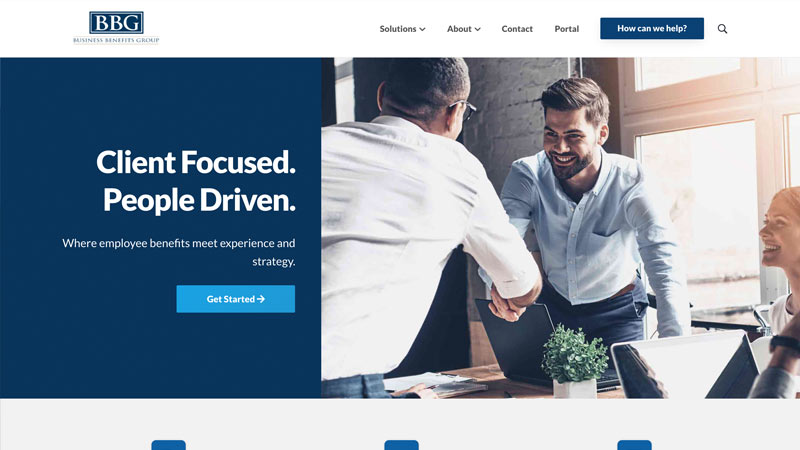

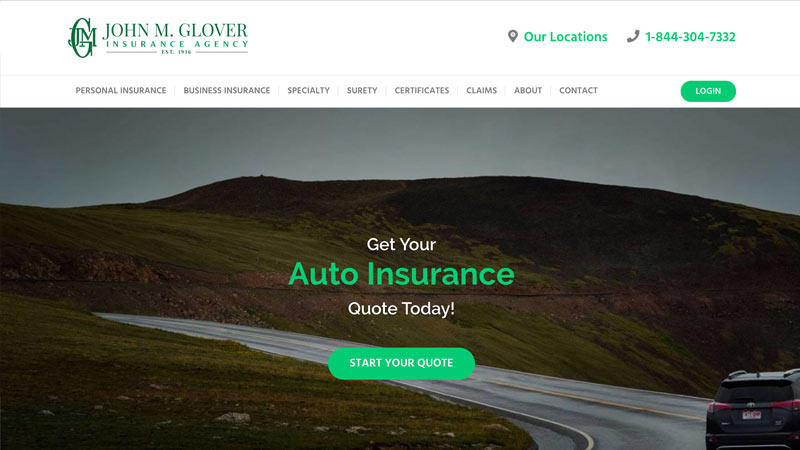

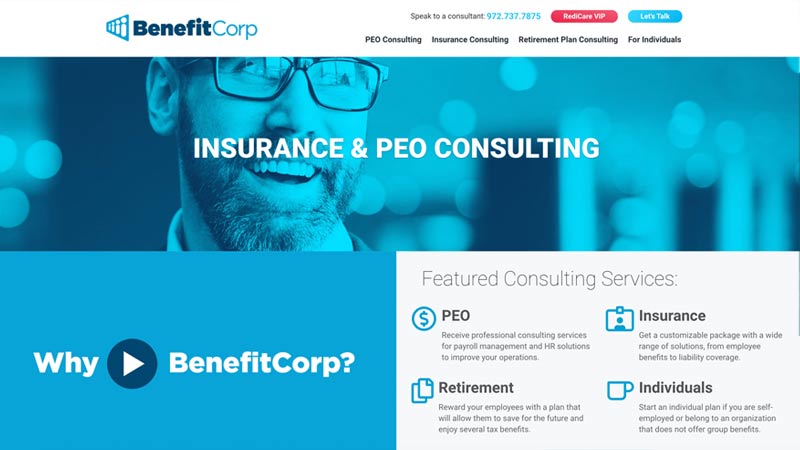

Below are 3 examples of insurance websites we support, click to check out their portfolios!

These websites, from left to right, are BenefitCorp, BBG Broker and JMG Insurance Agency. Feel free to click on them to see how their campaigns have been successful with 321 Web Marketing.

What Factors Of Website Design Keeps Users Interested?

If a potential client were to view an outdated site and it looked very untrustworthy and unprofessional, they will more than likely click off the page in favor of another agency. The same holds true for good looking websites – if your site is well-designed and maintained, visitors are almost certain to attribute the same level of professionalism and care that your website demonstrates to the policies you offer. It goes without saying that insurance websites with a poor user interface (UI) and user experience (UX) cannot compete with agencies that spend a good portion of their marketing budget on high quality website design.

Keep Users On Your Site With Fast Website Loading Time

Faster and more navigable websites will outperform those that do not, simply because most users will wait up to three seconds for sites to load before they turn away.

Additionally, when a visitor does reach your website in a fast amount of time, they do not want to scavenge your entire site to get the information they need.

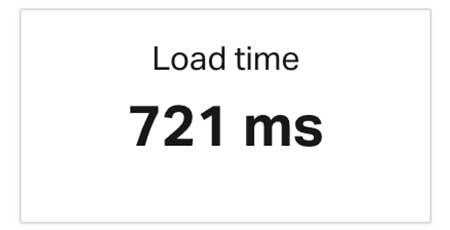

Figure 4.1

-

BBG Home Page Load Time

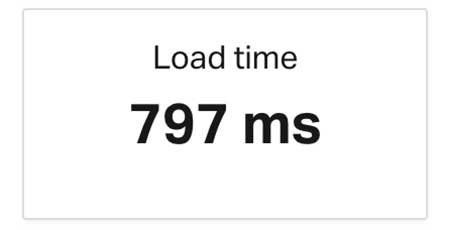

Figure 4.2

-

MFE Home Page Load Time

Figure 4.3

-

JMG Home Page Load Time

Figure 4.1 shows the load time of 721 milliseconds for the home page of BBG Broker. Figure 4.2 shows the load time of 797 milliseconds for the home page of MFE Insurance. Figure 4.3 shows the load time of 1.12 seconds for the home page of JMG.

We like to use this tool to check website load time. Try it out!

As we take a closer look at insurance website design, we will highlight three important facets – calls to action (CTAs), website responsiveness and website security.

Top 5 CTA’s That Increase Engagement On Insurance Websites

When you visit a website, especially one in the insurance industry, you may notice a ‘call to action’ sticking out somewhere on the page. Calls to action, or CTAs, are comprised of signals or phrases that entice users into taking the next steps toward a purchase.

These are generally placed in areas of the website that are most viewed, such as the front page or menu bar. CTAs are essential to lead production as they naturally draw the attention of users, informing them of what they can possibly do to engage with your business. They serve many purposes, from allowing visitors to sign up for your monthly newsletter to encouraging readers to speak with a representative over the phone. There are many types of CTAs that website developers frequently use, including the following:

1. Buttons That Drive Action

What do all of these have in common, you might ask? They are short, engaging phrases that stick out on the page and encourage people to take a no-risk action. These are frequently used, but effective calls to action that can be displayed as buttons to increase the likelihood of a user to click on it. Buttons may be considered the ‘oldest trick in the book,’ yet they continue to yield a significant return on investment (ROI). Whether your button leads to a free guide or a policy application page, it will be appreciated by individuals who want to get straight to doing business with you.

These elements are meant to demonstrate their design and user experience; they are not functional within the context of this page.

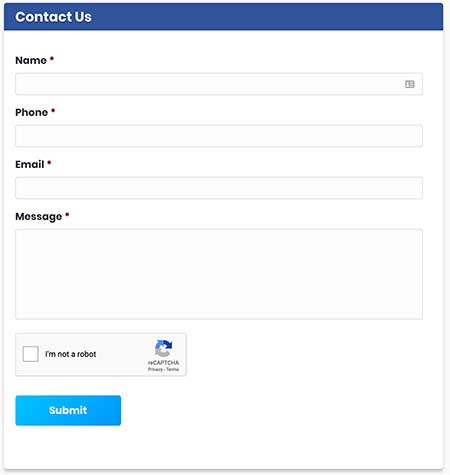

2. Forms That Are Easy To Understand & Complete

While condensed for your convenience (and also not working), this form is an excellent way for website visitors to contact your agency about any questions they might have, as well as state their wants and needs for their ideal insurance package. You can even utilize forms to get individuals to sign up for your free monthly newsletters.

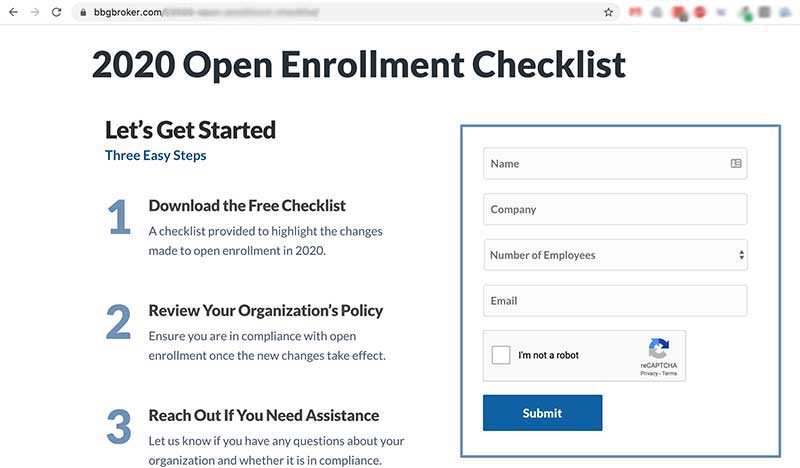

Figure 4.4

- Example Of A Contact Form

In addition, these customizable CTAs can have users schedule a consultation, apply for a specific policy, or even submit a job application. Whatever the case may be, forms serve as a perfect way to convert users into leads.

Figure 4.4 shows an example of a contact form that is easy for users to understand and fill out.

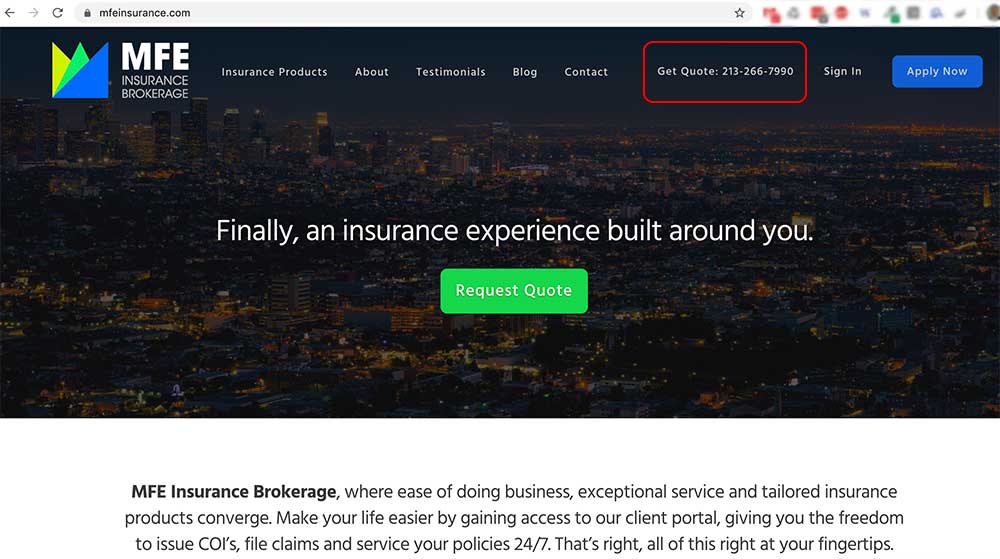

3. Phone Numbers That Are Accessible Throughout The Website

One of the biggest steps involved in getting individuals on the phone with your agency is helping them understand what number to call. If you have a CTA similar to the one shown above on your website, it provides a clear understanding of the number the user should dial to connect with you. For example, if you list a sales number on your site (and do not mark it as a sales number), but another page within the site displays a different unmarked number (which could be a direct line or billing number), it will only create confusion for the visitor and drive them away from your site and insurance company altogether. Figure 4.5 is the home page for MFE Insurance, and shows their phone number prominently displayed at the top of the website.

Figure 4.5

- MFE Home Page Showing Accessible Phone Number

4. Social Media Icons That Users Can Share Content

A big part of social media marketing involves getting users to share your website content across multiple platforms. What better way to encourage readers to share your content than conveniently placing share icons near the bottom of your articles? By doing this, you are enabling potential clients to spread the news about your insurance agency across a new wave of consumers. Without incorporating social media into your CTAs, your organization may not be discovered by otherwise unreachable individuals and markets.

These elements are meant to demonstrate their design and user experience; they are not functional within the context of this page.

5. Landing Pages That Increase Engagement & Action

Landing pages are unique website pages that are designed to capture leads. These pages are normally structured as the end destination of a ‘funnel,’ or a formulated sequence of pages that directs a user toward a course of action. In most cases, these actions include downloading a free guide or signing up for an individual, family, or business insurance consultation. Essentially, landing pages are a great way to convert users who value taking actions that involve no risks or obligations. Figure 4.6 shows a landing page for BBG Broker that encourages engagement and action.

Figure 4.6

- BBG Landing Page Example

Insurance Websites That Are Tablet & Mobile Friendly

Though your agency’s website may be full-fledged on a computer screen, it may not have ever been tested on a tablet, or even the smallest of iPhones. In fact, your insurance website may not even appear the same on a desktop monitor as it does on a laptop! With this in mind, it is crucial for websites nowadays to be presentable across all platforms as a little more than half of all Google searches come from mobile devices.

Consistent Ease Of Navigation On Any Device

Regardless of the page’s orientation (portrait, landscape) or aspect ratio (16:9, 4:3, etc.), it must appear as engaging and professional to the user as possible. Think about it – would you trust a brokerage to handle your insurance needs if their website was subpar and perhaps not working on your device? If your answer is no, then it is time to consider how a responsive website can impact your insurance company.

Consistency Across All Screen Sizes & Devices

Perhaps the biggest difference between desktop and mobile websites is the size of the screen. As most desktops themselves are larger in width than in height, desktop websites can be said to have a ‘horizontal layout.’ Phone screens, in contrast, while also being far smaller than computer screens, are often larger in height than they are in width. It’s not unlike looking at the outside world through a window. If the window is longer in width than in height, you’ll see a lot more than if those features are reversed. The aim of responsive design is to simply respond to these constraints, by rearranging content that is ordinarily set to a horizontal alignment to a vertical one when it is viewed on a mobile device. Figure 4.7 shows BenefitCorp on desktop, Figure 4.8 shows BenefitCorp on a tablet and Figure 4.9 shows BenefitCorp on mobile.

Figure 4.7

-

Desktop View

Figure 4.8

-

Tablet View

Figure 4.9

-

Mobile View

Certain technologies and page layouts are only native to desktop computers, leaving mobile devices with an incompatible design and functionality. That is why good website developers always optimize websites for mobile, as well as test them on all browsers and phone/tablet types.

Potential clients generally decide within the first few seconds of visiting your site whether they want to purchase a policy from you or not, and a well-structured website can significantly increase your chances of a sale. With a professional-grade website design that reflects the core beliefs and values of your agency, you can serve an excellent first impression to website visitors.

Website Security

Have you ever come across a site that looks untrustworthy? The first telltale sign is generally the prefix ‘http’ (HyperText Transfer Protocol) in the URL not containing an ‘s’ (Secure).

Become Secure With SSL Certificates

It has become increasingly important over the years for companies to obtain an SSL certificate for their website, which grants them the ‘secure’ status.

You may be wondering, what does this certificate do? Quite simply, it encrypts any form of data that is transferred from the website to the user, and vice versa. Therefore, visitors can feel more comfortable about performing transactions, signing up for newsletters, or potentially submitting personal information if applying for a job. Since the majority of cybercriminals are looking for new ways to breach companies with access to sensitive personal data, most notably insurance companies, it is especially important for your agency or brokerage to protect itself from making headlines in the wrong light.

Double Your Security With Two-Factor Authentication

Generally, the HTTPS websites that happen to be the most secure are those that utilize two-factor authentication, or 2FA. Perhaps you have a client who is interested in reviewing their policy through your client portal. To sign in, they need their password and their phone – something they know and something they have, respectively.

2FA not only lets the user feel better protected from an account hack, but also guarantees that nobody else can sign into their account.

We like to use this tool for two-factor authentication. Check it out!

Even if a cybercriminal were to maliciously retrieve a user’s password, they would not have access to the six-digit code provided by the user’s phone, which is updated every minute for extra protection. There are many 2FA applications that are compatible with websites, and it takes very minimal effort for users to enable 2FA on their account. With all of these resources made easily available, it is time to capitalize on the opportunity to strengthen the security of your website and attract more clients who can see that you value their privacy.

Insurance SEO (The Key To Building Your Agency)

SEO is the driving force behind any digital marketing campaign. Here’s how it impacts insurance agencies.

To avoid a long diatribe against the evolution of the internet over the years, let’s focus on why the internet is the most crucial shift to date. The ability to obtain, generate and disseminate information and communicate to millions of people almost instantaneously is invaluable.

Being able to reach your target audience, regardless of where they are in the world, opens the door to new business opportunities like never before. The internet made the ability for worldwide communication possible, Google made it a sales tool juggernaut.

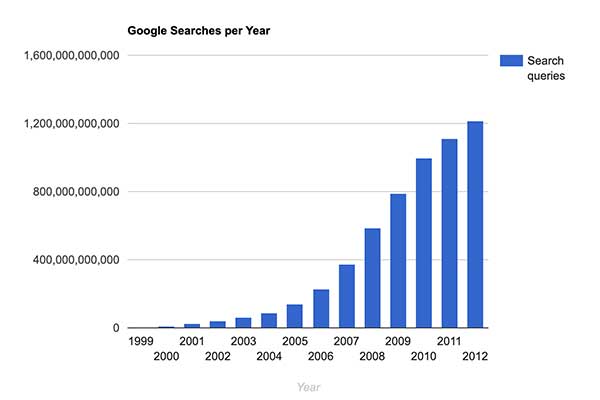

Figure 5.1

- Yearly Google Searches From 1999-2012

9 times out of 10, when someone wants to look for information, the first place they go to is Google. Google last reported their yearly total of searches in 2012, as shown in Figure 5.1. Since 2012, it has been said that Google now handles over 2 trillion searches per year and is continuing to climb. The combination of increased accessibility to the internet and use of search engines lead to one of the most powerful forms of marketing to date, known as search engine optimization (SEO).

Among the litany of industries that benefit from SEO, the insurance industry ranks as one of the top beneficiaries. There are many facets of SEO, but for insurance agencies, the following sections are the most important.

Create Engaging Content & Share It With The World

Content generation and dissemination (otherwise known as content marketing) is by far the most important aspect of SEO for insurance agencies. By producing engaging and information-rich content, potential clients are able to gather the information they need to make an informed decision before purchasing an insurance policy. This information will also build trust with the audience, knowing that your insurance agency has the experience and knowledge necessary to best serve their needs.

61% of U.S. online consumers have made a purchase based on recommendations from a blog – Content Marketing Institute*

*Content Marketing Institute

Once the content has been generated, the dissemination of the content is what sends the signals to Google as to what your website is about, and will begin to rank it accordingly. These may sound like simple tasks, but without proper research and targeting, efforts could easily go to waste.

Keyword Research Is An Absolute MUST

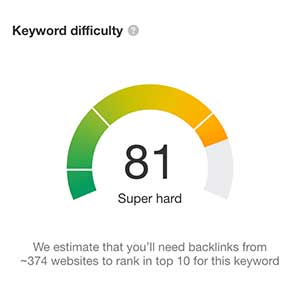

The first step in the content generation process is data analyzation through keyword research. Analysis tools like Ahrefs allows users to search for keywords relevant to their industry or services and view data such as monthly search volume, level of ranking difficulty and much more. By targeting valuable keywords and writing content relevant to those keywords, your agency will begin to rank for related search inquiries, thus increasing valuable traffic and qualified leads.

Figure 5.2

-

Keyword Difficulty

Figure 5.3

-

Monthly Search Volume

Figure 5.4

-

Cost Per Click Amount

Figure 5.2 shows data from Ahrefs for the keyword “health insurance”. This shows the approximated level of difficulty for ranking. Figure 5.3 data represents the monthly search volume for “health insurance”. Figure 5.4 shows the average CPC amount and the monthly traffic breakdown between PPC and organic search.

Engage Users With On-Page SEO To Rank Higher

After performing keyword research and creating the content, now you will post the content to a CMS (content management system), like WordPress. On-page SEO is the process of optimizing content internally by adding images (with alternative text for ADA compliance), inserting proper headers, adding internal and external links and ensuring the keyword you are targeting is mentioned enough throughout the text without spamming it.

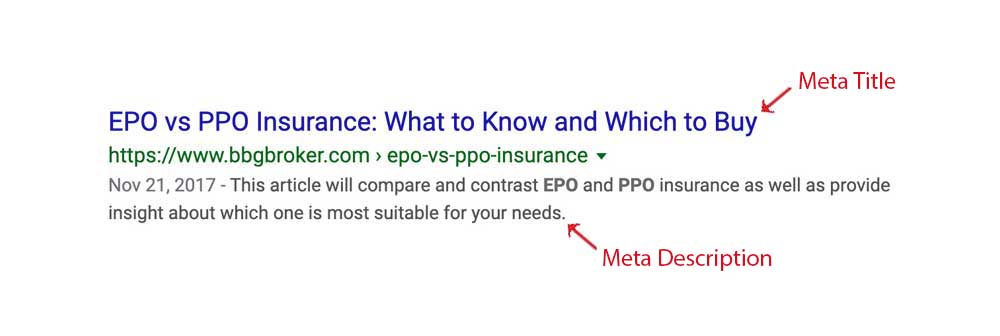

Meta Descriptions Are A Sales Pitch For Your Content

After the content has been optimized, the final step is to create a meta description for your content. A meta description is essentially a brief description of the content that “sells” it to searchers. In search engine results pages (SERPs), the meta description appears underneath the title of the content and provides insight to searchers as to what the content is about. Writing descriptive and informative meta descriptions increase the likelihood a searcher will click into and read your content. It also provides search engines context regarding what the content is about and will assist with ranking.

Figure 5.5

- Example Of A Meta Description

Figure 5.5 shows meta data for a BBG Broker blog, starting with the meta title (more commonly referred to as SEO title) at the top in blue, followed by the meta URL in green, and then the published date and meta description in gray.

Spreading Your Knowledge Across The Internet

After the content has gone live, the URL needs to be distributed throughout the internet. Some of the most common ways to distribute the content online include:

- Sharing on social media

- Creating press releases, adding the link within the pr and submitting the pr to online news outlets

- Performing outreach, requesting that the link be placed inside other relevant blogs

By disseminating the URL online, your website will begin to acquire backlinks from external domains, which is a critical aspect in performing SEO. We will discuss backlinks and the importance of acquiring backlinks in the next few sections.

Online Citations

Online citations are profiles and links placed within major and niche online directories. Some of the most common major online directories include Yellow Pages, Google My Business and Apple Maps. Niche online directories are valuable because they are specific directories related to an industry and being placed within those directories can lead to an increased amount of leads. For example, an insurance agency can benefit from being added to a directory like this.

Google places a heavy emphasis on consistency of information across the internet, more specifically for the name, address and phone numbers (NAPs) of businesses. Since Google values consistency of information across online citations, it is important to audit your agency’s current citations online so your agency can correct any citations that contain old or inaccurate information.

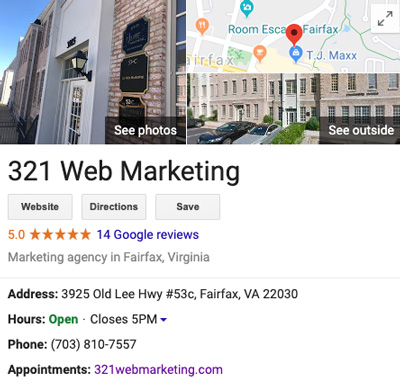

Google My Business Accounts Are Essential

Since Google is the leading search engine, creating and optimizing a Google My Business account is crucial for local SEO. When searchers are looking for an insurance agency online, the first agencies that appear will be ones that are local to the searcher.

Acquiring and adding a Google My Business account will also help potential clients find your agency when searching through Google Maps. This is why it is so important to create and optimize your GMB account, so that your agency will appear at the top of local SERPs.

Figure 5.6

- Google My Business Account Listing

Figure 5.6 shows the Google My Business account for 321 Web Marketing.

Acquiring Backlinks: The Complicated Secret To SEO

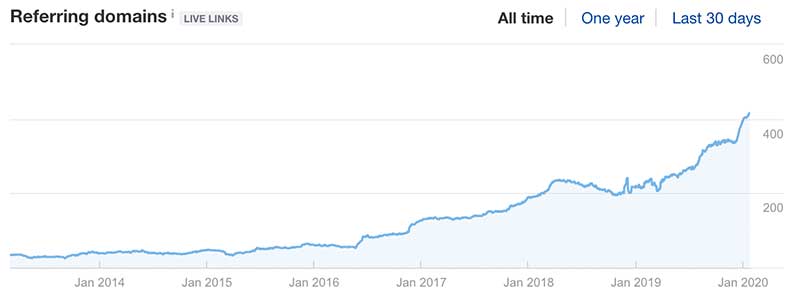

Backlinks are external links online that refer back to your website. Google views backlinks as a metric for determining the strength of your website and plays a major role in ranking. Websites that have internal backlinks to your website are called “referring domains.” Individual pages within these referring domains with have backlinks to your website are called “referring pages.” For example, insurance agencies who have referring domains from websites that are insurance specific are typically ranked higher than insurance agencies who have referring domains that are not related to insurance.

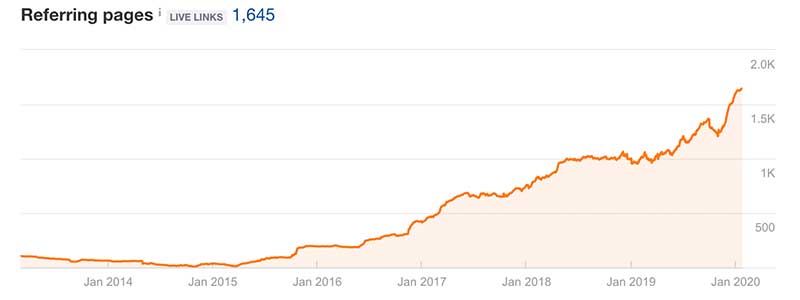

Figure 5.7

-

Referring Domains

Figure 5.8

-

Referring Pages

Figure 5.7 shows the growth of BBG’s referring domains over the years and Figure 5.8 shows the growth of BBG’s referring pages over the years.

Why Is SEO So Beneficial For Insurance Agencies?

Generally speaking, insurance is an essential product for most everyone. Let’s compare the need for insurance to say, to the need for cosmetic products. Insurance seems like the clear winner in terms of needs, even though cosmetic products will always be sought after. Not only are there countless options to choose from, there are numerous companies who offer cosmetic products, all of which can vary greatly in terms of pricing, availability & quality. These variances counter the benefits associated with yielding such high demand. Although a few of the aforementioned variances apply to insurance products, none of them vary quite as drastically.

Changes to the insurance industry are far and few between, and will likely remain that way for many years to come. Consumers typically shop for insurance based on pricing and their knowledge of and inherent trust with an insurance agency. In terms of pricing, it mainly depends on the consumer themselves (history, age, etc.) which means when they are shopping around, the pricing differences between agencies are minimal. Taking that into consideration, it seems that consumers make their decision on which agency they are going to purchase insurance through, primarily based on what agency they know and trust.

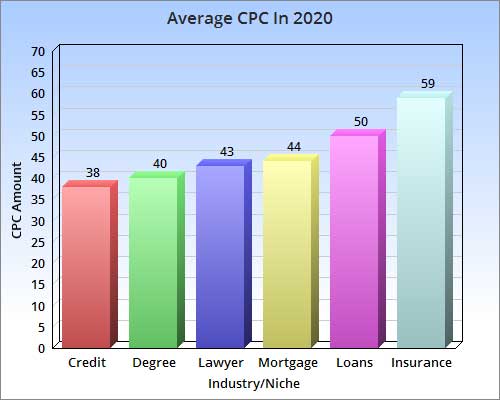

Organic SEO Is Much More Cost Effective Than PPC

Figure 5.9

- Average CPC By Industry

While there are benefits associated with pay per click (PPC) advertising, the average amount of money needed to see results for insurance related keywords are significantly higher than costs of performing organic SEO. As shown in Figure 5.9, for keywords related to insurance, the average cost per click is $59. The insurance industry is the most costly industry to engage in pay per click advertising.

In addition to the cost, PPC Ads will only appear to searchers as long as they are being paid for. Organic SEO builds over time, so say your insurance agency performs SEO for a year, you begin to rank on the front page of Google and then you quit performing SEO. You will still see the results of performing SEO after stopping (although those results will diminish over time), whereas PPC results will disappear immediately.

Insurance SEO Builds Brand Awareness & Increases Visibility

Before the internet and the ability to reach virtually anyone anywhere, local insurance agencies built their client base with, well, local clients. If an agency from Fairfax, VA tried to reach out to potential clients in Seattle, WA, it would be difficult to build trust with someone who would have never heard of them. Now, this local agency has the ability to build their brand awareness and establish credibility to those seeking insurance products online regardless of their location. Although this increased amount reach is possible, the agency must first be able to be seen by these potential clients.

By performing SEO, your agency will begin to increase visibility online and, in turn, will become more visible to potential clients consistently.

Should I Be Investing In Social Media Marketing?

Sometimes, social media marketing helps. Sometimes, it doesn’t. Let’s find out if if will help your agency.

We highlighted the importance and benefits of social media marketing on our insurance social media marketing page. However, you may still have questions about whether it is truly worth the investment. While social media marketing can be highly useful, it should definitely not be utilized without the help of SEO. That is because some of your agency’s social media posts will be based on the content found on your website. Additionally, social media is generally used to generate awareness of and interest in your brand, and not necessarily to close business.

An important factor to whether social media marketing will be effective or not is the size of your brand. Learn more about the impacts that utilizing social media can have on large vs small agencies.

Smaller Insurance Agencies & Brokerages

While your agency may have the budget to employ social media marketing, it is generally not as important since it needs to focus on SEO in order to grow its book of clients. As mentioned before, social media is not a place for closing business, which should be the number one priority while your agency expands. After several months of investing in SEO and experiencing a steady flow of leads, your insurance agency can then reassess whether it should begin investing into social media marketing.

Larger Insurance Agencies & Brokerages

Social media marketing is highly recommended for agencies that have a well-established client base and a successful SEO campaign. Insurance agencies with a large amount of content on their website can use it to formulate a social media strategy. Larger agencies and brokerages have more favorable data and statistics about their firm than smaller ones – therefore, they can share this information with qualified individuals who may see a phrase such as “over 2 million individuals insured” and instantly gain interest in the policies you offer.

Email Marketing & How to Use It Effectively

This section will highlight the benefits of email marketing and describe how to effectively utilize it.

Email marketing is one of the more widely used marketing strategies in the insurance industry. According to a study conducted in 2015, about 91 percent of adults enjoy receiving emails from organizations they work with.

By regularly sending out monthly newsletters to current and or potential clients, you are providing these recipients constant reminders about your agency and the products and services offered. These reminders increase the likelihood of new or repeat business from recipients when it comes time to acquire a new insurance policy. Email marketing platforms, like Mailchimp, can provide your organization with data including the number of emails opened, links clicked and time spent viewing the email. Whatever your agency or brokerage chooses to utilize email marketing for, it can provide significant benefits when attempting to attract new customers and keep current ones. Below are just a few:

Inform Potential Clients About Your Agency

One of the benefits of email marketing is the ability to send a monthly newsletter to potential (and current) clients. Giving individuals the option to voluntarily sign up for your monthly email push will allow them to connect with your agency once a month. In this newsletter, your agency or brokerage can deliver announcements, provide incentives when acquiring a new policy, or simply just touching base with subscribers. You can also inform your audience about events in the community or share your recent experiences in the area with them. Individuals like brands that are personable and relatable – monthly newsletters are a great way to show your agency holds both these traits.

Provide Updates to Existing Clients

Another benefit of email marketing is being able to provide information to policyholders. By sending out emails to your clients, you can let them know about new lines of coverage, changes in rates, or upcoming promotions. You can even remind them about open enrollment deadlines or any other important dates regarding insurance. Opening this line of communication between your business and its clients can increase customer retention as they will constantly look forward to updates from you. Even something as simple as wishing a policyholder a ‘happy birthday’ can make them feel welcomed by your agency – not only as a customer, but also as a person that values organizations that take extra steps to ensure client satisfaction.

Insurance Marketing Frequently Asked Questions

Here are a ton of questions we often get from insurance agencies, including some you may have. Find out more!

We have now covered most of the ins and outs of the campaign process and execution, but there are still a few remaining items to be addressed. Because of this, we have compiled a list of the most frequently asked questions we get from our new insurance clients. Feel free to review some of these questions below, as they may be helpful to you when determining if an insurance marketing campaign will provide your agency or brokerage with an advantage.

-

If your agency just recently opened its doors, or has served a smaller community for several years, it is beneficial to begin marketing within your state. For instance, if you operate in Austin, TX and currently only have clients nearby, your agency would receive immediate benefits from marketing strictly to Texas. Until you begin to gain a large book of clients in your state, you should not worry about marketing your agency to any other region. During this time, however, your agency should still accept qualified leads and clients from outside of the state. Additionally, your in-state marketing efforts may also include pay-per-click to increase the likelihood of users viewing your website in relevant SERPs.

As your agency begins to dominate the state it operates in, or if it is already well-established in the state, 321 Web Marketing will help your agency market nationally. Regardless of your plan to acquire new offices across the country (or not), we will perform heavy local SEO in both the city and the state you perform business in for all of your insurance options, while performing national SEO on your most profitable policies. Essentially, when your campaign generates steam and the numbers show a steady increase, your agency should market all your services nationally while placing important on the insurance policies or packages that are predicted to generate the highest return on investment (ROI) for your company.

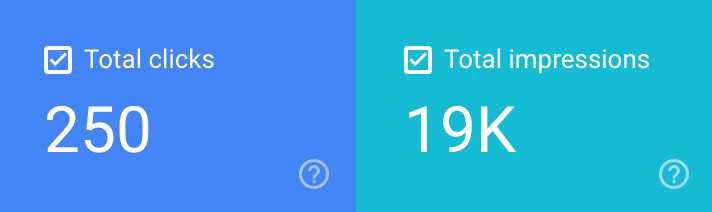

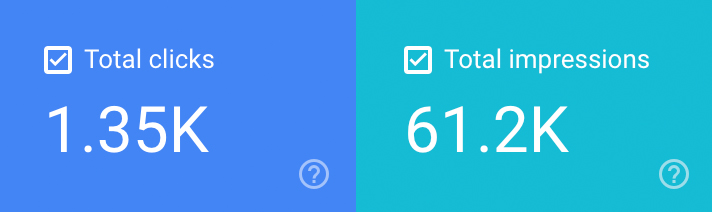

-

Insurance marketing campaigns can take several months before results begin to show. While this is a good rule of thumb, some agencies may see results faster or slower based on their target market. In most cases, your agency will experience a favorable amount of website traffic and conversions within six months of launching its campaign. When working with 321 Web Marketing, we provide a monthly report that shows data including the amount of domains and pages linking to your site, keyword rankings, ad clicks (when applicable), website traffic and qualified leads. Here is an example of data we collected from MFE Insurance’s campaigns:

Month 3:

Month 12:

The data above is based on the clicks and impressions in Google for MFE Insurance over 12 months.

You may notice a large spike in traffic within the first six months of your campaign – generally, this means that the SEO is working and the keywords you have targeted registered properly in search engines. Once one of your pages begins ranking in SERPs, others will begin to follow. Insurance SEO is not an overnight process, however, and you should experience smaller but steadier results after the initial bump in traffic occurs. It may take up to a year for your insurance company to dominate the local SERPs, but you may receive faster results through regularly approving content for us to publish to your site.

-

At 321 Web Marketing, we advise most insurance agencies that website design and search engine optimization are the two most likely services to provide a substantial ROI. Website design is an important aspect of an insurance marketing campaign as it keeps users engaged and on your site for longer periods of time. Search engine optimization is equally as important because it is ultimately what causes your company to be discovered online in the first place. When paired together, these services alone can create an effective and powerful marketing campaign. All you need to do is enlist the help of 321 Web Marketing, and with a brand-new website and well-marketed services, your agency will quickly receive an ROI.

The other services mentioned previously, such as PPC, social media and email marketing can certainly provide a decent ROI, but are not strong enough to generate results on their own. When added to a campaign that includes SEO and web design, they can certainly prove helpful. However, these services are nearly incapable of capturing leads alone. PPC may be able to generate a boost in website traffic, but without a professional-looking website, the potential leads that come in will most likely be nullified. Furthermore, PPC requires additional fees from the search engine, meaning the cost per click of the insurance keyword(s) you choose to target may significantly exceed the amount of money you get back.

-

This is sometimes a tough question to answer because each insurance product is different, and each individual that contacts your agency will have their own unique case. Most of the leads you will receive online or by phone will be qualified, but it may depend on which service they are interested in. For example, if you provide benefits packages for businesses as your most profitable line of coverage, but they apply for your least profitable coverage option, it is technically still a qualified lead. Our campaigns, however, are designed to target specific policies you offer that will bring in the most money. Therefore, it is hard to tell just how qualified your leads will be.

Clients have the ability to work with 321 Web Marketing’s lead tracking system to listen to phone calls and view web form submissions. While there is currently no human verification method for calls, we place a captcha on each form to guarantee the submissions are protected from spam. Form entries require a name, email and phone number to be submitted by the user. If you can get in contact with them after they provide their information, and they seem legitimate, it is most likely a qualified lead. Likewise, if an individual calls your sales number to get a quote on auto insurance, for example, it is a qualified lead in most cases. However, if they call your sales number when they meant to call the billing department, it is considered a lead but not a qualified one.

Speak To The Insurance Marketing Professionals

Now that you have read through our comprehensive insurance marketing guide, you should have a reasonable understanding about the importance of digital marketing in the insurance industry. That said, you may not have the internal resources required to launch an effective insurance marketing campaign. Fortunately, 321 Web Marketing has everything – the knowledge, experience and support – that your agency needs to increase its book of clients.

The digital marketing department at 321 Web Marketing will design and implement an insurance marketing campaign that will boost the amount of traffic your website receives, while working to increase the lead conversion rate among those visitors. Additionally, our website development team can handle all of your web design wants and needs, from simple navigation menus to custom page layouts. We are equipped with the latest technology that help keeps your website up and running 24/7, regardless of the amount of traffic on your site.

Most of the insurance companies that work with us yield significant results. Don’t believe us? Feel free to take a look at our marketing case study below and see why agencies and brokerages of all sizes enlist the help of 321 Web Marketing!

Related Article:

UPDATED: 03/17/2022