Our team of digital marketers here at 321 Web Marketing are no strangers to the insurance industry. We have been successfully running campaigns for insurance agencies since 2013, and even a few of our marketers used to work in the insurance industry! Not only do we know how to generate informative content across a vast amount of policies, but we do so while remaining and adhering to compliance standards.

The case study below, showcases our insurance marketing prowess through in depth explanation of our process and data from our work. We respect the confidentiality of our clients, so we will be referring to our client throughout this case study as “Insurance Agency“.

Insurance Agency Background & Pain Points

March 2016, Insurance Agency contacted us to see how we could increase the visibility online and overall brand awareness. Insurance Agency had been operating for quite sometime, but they realized that being able to reach their target audience online was the future of growing their agency. There were two major pain points identified:

March 2016, Insurance Agency contacted us to see how we could increase the visibility online and overall brand awareness. Insurance Agency had been operating for quite sometime, but they realized that being able to reach their target audience online was the future of growing their agency. There were two major pain points identified:

- Lead Generation Declining

- Inability To Reach Clients Outside Of Their Area

Insurance Marketing Campaign Goals

The identification of their pain points clearly showed the need for digital marketing. Therefore the goals needed to make this campaign successful were apparent.

- Increase Brand Awareness

- Increase Online Visibility

- Increase Lead Generation

Insurance Marketing Strategy

Preparing a strategy for this campaign was different than most, being that most of their competitors were in similar situations. This unique situation was a blessing and a curse. It was a blessing because we would be able to build a strong digital presence for our client without much competition, but a curse because we were unable to identify what digital marketing efforts were being conducted correctly and what efforts were being done incorrectly. However, we were able to construct a strategy hypothesis based on the goals of the campaign and their target audience.

Strategy Hypothesis

Although a majority of their competition did not have a strong digital presence (or a presence at all), we were still able to analyze competitors that were engaging in digital marketing. By analyzing their (low sample) competition, goals and target audience, we were able to create a strategy hypothesis based on the following factors.

Factor #1

A majority of the content related to insurance policies online was either dry to read or was lacking information one would require to make an informed decision. By creating a vast library of informative content related to insurance policies, users would be able to make insurance decisions more quickly and confidently. The confidence users experienced during the buying process would inevitably lead to an increased amount of referrals to their friends and colleagues.

Factor #2

A majority of local businesses require insurance for their employees and often have to turn to big corporations to acquire those policies. By increasing the visibility online locally, local business owners would often choose a local insurance brokerage over a national corporation.

Hypothesis Implementation

Before launching the website, we created a robust library of content related to all of their insurance offerings to ensure users could make an informed decision before purchasing. In addition to the large volume of insurance related content created, we also created what we call “geo pages”, which discussed individual cities and counties within their area. These geo pages were created in the following format, {{ City, State }} Insurance Agency

Geo page title example: “Fairfax, VA Insurance Agency”

Results Of The Strategy

Through the creation of informative insurance related content and individualized geo locational pages, we were able to rank Insurance Agency locally on the front page of Google within months. Within a year, Insurance Agency was ranking on the front page of Google for 109 keywords nationally. Currently (2019), Insurance Agency rank higher than corporations like Aflac and Geico for keywords such as “benefits consultant”.

Substantial Growth In Organic Keywords & Traffic Value

There is a high correlation between the amount of keywords your website ranks for on the front page of Google, and the value of traffic your website receives. Let’s face it, if your website appears on the 2nd page or beyond on Google search results, you might as well not exist.

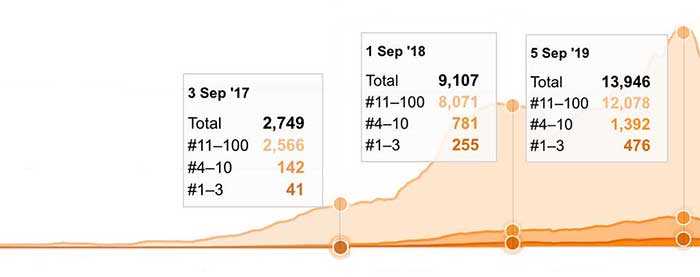

1 Year KW Growth

- #11-100: +5,505

- #4-10: +639

- #1-3: +214

2 Years KW Growth

- #11-100: +9,512

- #4-10: +1,250

- #1-3: +435

Figure 1.1 shows the growth of ranking keywords over the course of the insurance marketing campaign.

1 Year Growth

$49,545

2 Years Growth

$77,524

Figure 1.2 shows the growth of traffic value throughout the campaign. The amount of traffic value shows how much it would cost in paid ads to get the same amount of traffic.

Significant Increase In Organic Traffic

Organic users are users who enter your website through a search engine. Continuous increases in the volume of organic users each month is directly correlated with increases in online visibility, brand awareness and search result rankings. Traffic via organic users means searchers are finding your website in search results for keywords you are ranking for.

Figures 1.3, 1.4 & 1.5 show organic user data from September 2016 (first year of insurance marketing campaign), September 2017 & September 2019, respectively.

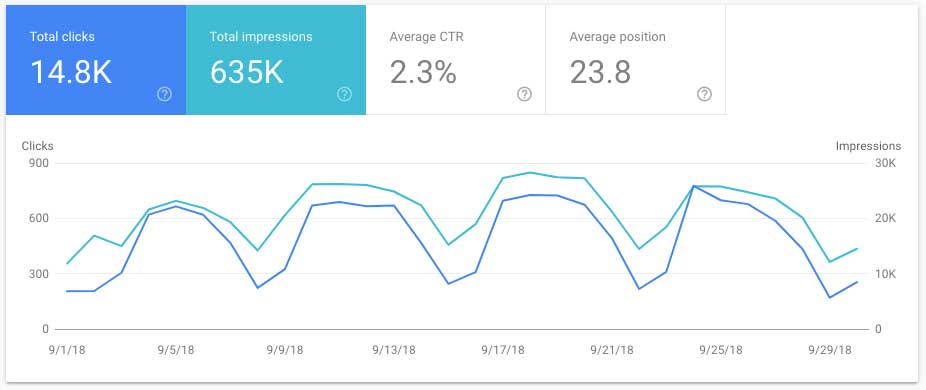

Vast Improvement In Clicks & Impressions

Impressions are often considered not as valuable as clicks when determining KPIs for a digital marketing campaign. Even though clicks are a more tangible metric for assessing lead growth, impressions are most often the foundation that lead to increased clicks and overall leads. An increased volume of impressions signifies the growth of online visibility and brand awareness. The more visible your website is online, the higher the probability is that your clicks will increase.

Impressions are logged when your website or ad appears and is visible on a searchers screen.

Clicks are logged when a searcher actually clicks on your website or ad.

Figures 1.6 & 1.7 show the difference between September 2018 (after 2nd year of campaign) and September 2019 (after 3rd year of campaign). These comparisons show how a well executed SEO campaign compounds over time.

Continuous Generation Of Qualified Leads

Increasing leads is important, continuous lead growth month after month is more important. Being able to generate a high volume of leads every month is the key to a successful business. Increases in clicks & impressions lead to an increase in organic users, and an increase in organic users leads to an increase in qualified leads.

Figures 1.8, 1.9 & 1.10 represent monthly lead data from September 2017 (after 1st year of campaign), September 2018 (after 2nd year of campaign) & September 2019 (after 3rd year of campaign).

Results Summarized

For a more visualized representation of our results from the insurance marketing campaign, here is a table which outlines the results after each year.

| KPIs | 1st Year | 2nd Year | 3rd Year |

|---|---|---|---|

| Total KWs | 2,749 | 9,107 | 13,946 |

| 1st Page KWs | 183 | 1,036 | 1,868 |

| Traffic Value | $10,772 | $60,317 | $88,296 |

| Monthly Users | 1,013 | 4,578 | 46,578 |

| New Monthly Users | 948 | 4,434 | 45,480 |

| Monthly Clicks | – | 14,800 | 26,000 |

| Monthly Impressions | – | 635,000 | 1,220,000 |

| Monthly # of Qualified Leads | 85 | 119 | 153 |

Speak To Our Insurance Marketing Experts

We work with insurance agencies across the nation and have produced similar results for each one. Our expertise in insurance marketing ranges from standard life insurance policies to cannabis insurance policies and everything else in between. Whether your insurance agency is in California or right here in Fairfax, 321 Web Marketing knows how to get your website in front of millions of prospective clients.