Independent insurance agencies can widely promote themselves and boost revenue from insurance marketing campaigns. They require a digital marketing team who understands the different types of insurance and know how to funnel prospects to their agents from the internet. While digital marketing may not the first thing that comes to mind when operating an insurance agency, it has shown to attract the best business brokers and agencies alike.

Our clients surpass their competition with our conversion-friendly websites, content generation that speaks to search engines and the target market, email marketing, and social media marketing. With our expertise, your insurance agency can receive higher website traffic, higher sales conversions, higher cross-sells, and increased revenue.

Free Insurance Agency Marketing Consultation

Reach out to our experts to see how we can grow your organization in the insurance agency industry today!

Schedule MeetingBenefits Of Digital Marketing For Insurance Agencies

Reach Your Target Audience

Insurance marketing services establish, maintain and deliver powerful messages for your brand. It also propels brand awareness, online visibility and company growth, by consistently transforming a target audiences into qualified leads.

Establish Credibility & Trust

By developing a responsive, enterprise-level website design, your potential clients are likely to establish brand trust. Likewise, an effective content marketing strategy allows your company to provide useful information to users visiting your website.

Increase User Engagement

Content marketing and email marketing enable your client base and potential customers to engage with your agency or brokerage through email newsletters and relevant content on your website.

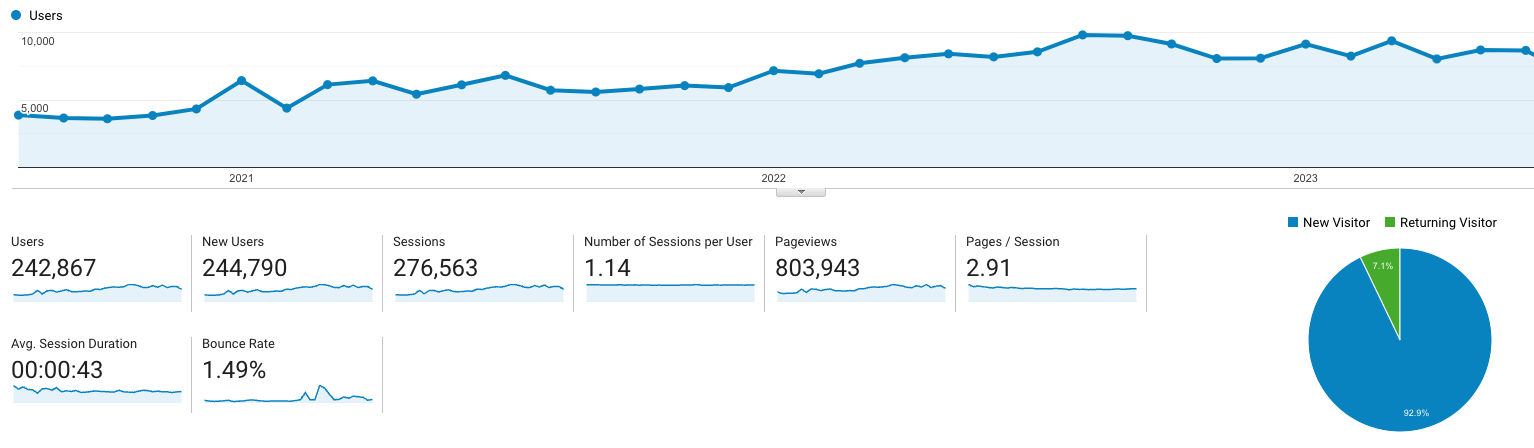

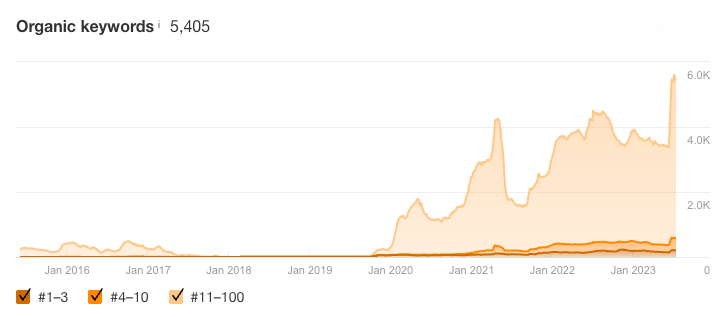

Proven Success With 321 Web Marketing

426 Keywords

5,405 Keywords

574 Keywords

Want to learn more about how we approach insurance marketing campaigns?

Our Top Insurance SEO Specialists

Brind’Amour

Frequently Asked Questions

-

If your agency just recently opened its doors, or has served a smaller community for several years, it is

beneficial to begin marketing within your state. For instance, if you operate in Austin, TX and currently

only have clients nearby, your agency would receive immediate benefits from marketing strictly to Texas.

Until you begin to gain a large book of clients in your state, you should not worry about marketing your

agency to any other region. During this time, however, your agency should still accept qualified leads and

clients from outside of the state. Additionally, your in-state marketing efforts may also include

pay-per-click to increase the likelihood of users viewing your website in relevant SERPs.As your agency begins to dominate the state it operates in, or if it is already well-established in the

state, 321 Web Marketing will help your agency market nationally. Regardless of your plan to acquire new

offices across the country (or not), we will perform heavy local SEO in both the city and the state you

perform business in for all of your insurance options, while performing national SEO on your most profitable

policies. Essentially, when your campaign generates steam and the numbers show a steady increase, your

agency should market all your services nationally while placing important on the insurance policies or

packages that are predicted to generate the highest return on investment (ROI) for your company.

-

Insurance marketing campaigns can take several months before results begin to show. While this is a good

rule of thumb, some agencies may see results faster or slower based on their target market. In most cases,

your agency will experience a favorable amount of website traffic and conversions within six months of

launching its campaign. When working with 321 Web Marketing, we provide a monthly report that shows data

including the amount of domains and pages linking to your site, keyword rankings, ad clicks (when

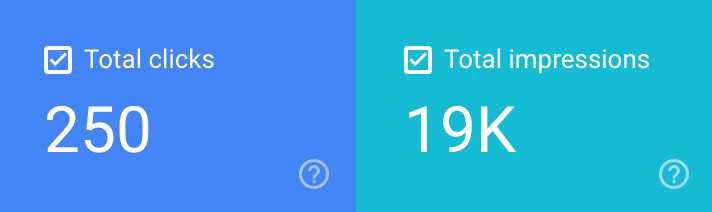

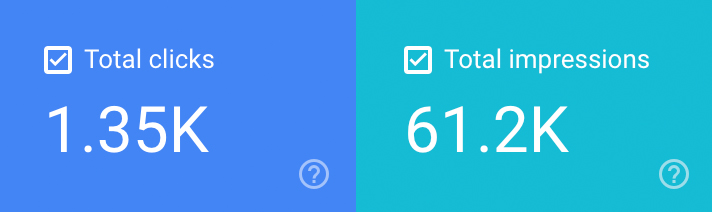

applicable), website traffic and qualified leads. Here is an example of data we collected from MFE

Insurance’s campaigns:Month 3:

Month 12:

The data above is based on the clicks and impressions in Google for MFE Insurance over 12 months.

You may notice a large spike in traffic within the first six months of your campaign – generally, this means

that the SEO is working and the keywords you have targeted registered properly in search engines. Once one

of your pages begins ranking in SERPs, others will begin to follow. Insurance SEO is not an overnight

process, however, and you should experience smaller but steadier results after the initial bump in traffic

occurs. It may take up to a year for your insurance company to dominate the local SERPs, but you may receive

faster results through regularly approving content for us to publish to your site.

-

At 321 Web Marketing, we advise most insurance agencies that website design and search engine optimization

are the two most likely services to provide a substantial ROI. Website design is an important aspect of an

insurance marketing campaign as it keeps users engaged and on your site for longer periods of time. Search

engine optimization is equally as important because it is ultimately what causes your company to be

discovered online in the first place. When paired together, these services alone can create an effective and

powerful marketing campaign. All you need to do is enlist the help of 321 Web Marketing, and with a brand

new website and well-marketed services, your agency will quickly receive an ROI.The other services mentioned previously, such as PPC, social media and email marketing can certainly provide

a decent ROI, but are not strong enough to generate results on their own. When added to a campaign that

includes SEO and web design, they can certainly prove helpful. However, these services are nearly incapable

of capturing leads alone. PPC may be able to generate a boost in website traffic, but without a

professional-looking website, the potential leads that come in will most likely be nullified. Furthermore,

PPC requires additional fees from the search engine, meaning the cost per click of the insurance keyword(s)

you choose to target may significantly exceed the amount of money you get back.

-

This is sometimes a tough question to answer because each insurance product is different, and each

individual that contacts your agency will have their own unique case. Most of the leads you will receive

online or by phone will be qualified, but it may depend on which service they are interested in. For

example, if you provide benefits packages for businesses as your most profitable line of coverage, but they

apply for your least profitable coverage option, it is technically still a qualified lead. Our campaigns,

however, are designed to target specific policies you offer that will bring in the most money. Therefore, it

is hard to tell just how qualified your leads will be.Clients have the ability to work with 321 Web Marketing’s lead tracking system to listen to phone calls and

view web form submissions. While there is currently no human verification method for calls, we place a

captcha on each form to guarantee the submissions are protected from spam. Form entries require a name,

email and phone number to be submitted by the user. If you can get in contact with them after they provide

their information, and they seem legitimate, it is most likely a qualified lead. Likewise, if an individual

calls your sales number to get a quote on auto insurance, for example, it is a qualified lead in most cases.

However, if they call your sales number when they meant to call the billing department, it is considered a

lead but not a qualified one.

Schedule An Insurance Marketing Consultation

Are you ready to see how 321 Web Marketing can skyrocket your insurance agency to the front page? Fill out our

form to start your journey to the front page today!

"*" indicates required fields