Data has become a powerful driver of growth. If your organization isn’t collecting, analyzing, and building with data, you are missing out on capturing your market share. This can make or break opportunities in the financial industry.

Data has become a powerful driver of growth. If your organization isn’t collecting, analyzing, and building with data, you are missing out on capturing your market share. This can make or break opportunities in the financial industry.

Market analytics are the most important source of data used to fuel growth. This is your inside look at the most effective analytics to power a search boost.

Understanding the Role of Marketing Analytics in Financial Growth

Market analysis is more than one set of numbers. Data from the past, present, and projected future, as well as metrics of your competition, must all be taken into consideration for a comprehensive strategy.

Data should show you who, why, when, and how people are searching and buying from you and your competition. And then, you need to predict their next move, and yours.

Marketing analytics are metrics based on numbers and statistics that tell the story of target audiences, demand, and more.

KPIs, short for key performance indicators, quantify the success (or lack thereof) of a marketing campaign based on performance objectives.

Descriptive analytics evaluate historical information and identify insightful patterns.

Diagnostic analytics are used to analyze data and obtain a better sense of the underlying causes of consumer actions and sales outcomes.

Predictive analytics refer to the process of data-crunching in an attempt to forecast organization outcomes using the following:

- In-depth analysis

- Artificial intelligence

- Statistical modeling

- Machine learning

Predictive analytics is the data obtained through advanced tools and processes that suggest ideas for capitalizing on opportunities, or at a bare minimum, reduce risk. The most in-depth predictive analytics identify the implications of each potential decision.

Financial services providers and other organizations use descriptive analytics as statistical interpretations to analyze historical information and identify insightful patterns. Using this information, organizations have a valuable point of reference for trend-tracking that boosts finance SEO.

The specific KPIs that are ideal for your financial services organization won’t be exactly the same as those for another company. Focus on KPIs that can be measured with ease and accurately tracked as time progresses.

Ideally, the KPIs you select will be highly actionable, meaning they offer information that shapes decision-making and ensuing action.

Benefits of Marketing Analytics for Financial Organizations

The right marketing analytics make it easier to develop effective strategies and make decisions. Basing decision-making on information gleaned through analytics instead of relying on your gut instinct, and you’ll better understand customer insights for appropriate segmentation making it easier to optimize marketing campaigns and see an increased return on investment (ROI).

The right marketing analytics for your financial organization will empower you to pinpoint opportunities to win market share, expand operations, and add to the bottom line.

Essential Marketing Analytics Tools and Technologies

Search the web for financial organization marketing analytics, and you’ll find a seemingly endless number of pages detailing tools, technologies, and more.

Search the web for financial organization marketing analytics, and you’ll find a seemingly endless number of pages detailing tools, technologies, and more.

Here’s a quick breakdown on what you should be leaning into:

Analytics tools provide lead tracking that documents and manages the movement of target clients into and through the sales funnel. Lead tracking helps pinpoint prospects at specific sources then analyzes individual sales funnel stages to facilitate even more sales.

CRM systems (customer relationship management systems) including the ever-popular Hubspot, have emerged as important technologies for managing customers. Carefully select the right CRM system for your organization, and you’ll take full advantage of a system that does the following and more:

- Streamlines processes

- Boosts customer relationships

- Improves finance SEO

- Increases sales

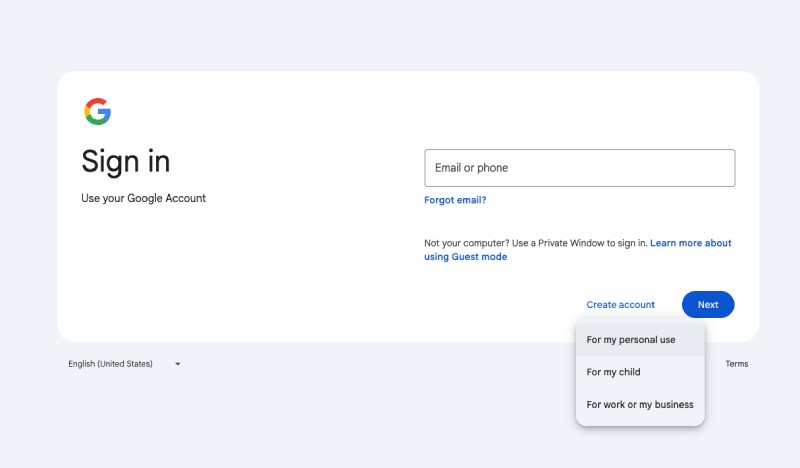

Web analytics platforms are invaluable tools for learning more about prospect and customer behavior. Review the data collected by these analytical tools and you’ll glean insight about industry-relevant keywords, link building, and even valuable information about competing financial organizations’ online marketing strategies. Some of our top web analytics platforms include:

- Ahrefs

- Google Search Console

- Google Analytics

Social Media and Email Marketing

Inbound marketing is incomplete without social media analytics and email marketing analytics tools. Email marketing, when used correctly, presents an opportunity to connect with a sizable audience at your preferred frequency.

Analytics tools help financial organizations accomplish the following:

- Understand email open rates

- Pinpoint email newsletter subscription trends

- Quantify sales related to email marketing

Marketing Analytics in Financial Organizations

Gathering marketing analytics is only half the battle. The other half is the implementation of those analytics. Begin by defining your objectives for inbound marketing. Once you have an idea of what you are looking for, begin collecting data within that framework.

Case Studies

1. The value of marketing analytics is on clear display with the case study of Amazon’s personalization of customer experiences in 2019. The e-tailer boosted online sales through an evaluation of the shopping experience using in-depth marketing analytics.

Amazon tracked the following metrics that set the stage for success:

- Customer retention rate

- Customer acquisition cost (CAC)

- Net promoter score (NPS)

- Return on investment (ROI)

- Customer lifetime value (CLV)

2. McDonald’s is another marketing analytics success story. The fast food chain used social media marketing analytics to better understand its online audience and expand reach.

McDonald’s top social media marketing analytics included:

- Click-through rates (CTR)

- Impressions

- Reach

- Retweets

- Shares

- Likes

- Reactions

3. Zara, an online fashion e-tailer, used marketing analytics to better balance stock for revenue streamlining. In particular, Zara’s brass zeroed in on predictive analytics including seasonal trends to assess sales cycles, market sentiments, and real-time sales data.

Customer Analytics for Growth

Customer analytics are central to the ongoing push for growth and capturing market share.

Customer analytics are central to the ongoing push for growth and capturing market share.

Financial organizations willing to put in the effort to leverage customer analytics through the precise measuring of metrics such as satisfaction and loyalty enjoy additional opportunities for growth.

Data-driven insights ultimately improve the customer experience through strategic targeting and ongoing personalization.

Predictive Analytics for Strategic Marketing

Use the data at your fingertips to predict the future, and you’ll find strategic marketing is that much easier. Predictive analytics empowers you to forecast market trends including customer behavior.

This approach to analytics helps organizations accomplish the following and more:

- Pinpoint potential opportunities for growth

- Identify potential scenarios

- Assess specific risks

Case Studies

1. Consider how Johns Hopkins Hospital used predictive analytics to accurately predict patient outcomes. The hospital was saddled with an elevated frequency of patient readmissions a month or less after discharge.

The hospital used predictive analytics modeling to:

- Minimize churn

- Reduce costs

- Improve patient care quality

The predictive analytics model consisted of more than 200 variables from patient electronic health records including the details of hospital stays, lab results, and medical history.

The model predicted the chances of readmission a month or less after initial discharge, setting the stage for personalized care plans in combination with preventive measures.

The results were impressive: A reduction in patient readmission frequency by 10% and lower costs.

2. Walmart is another sterling example of how corporations use predictive analytics to forecast the future. The company’s advanced predictive analytics models study vast amounts of information pertaining to:

- Weather forecasts

- Local events

- Trends

- Customer purchases

The models make it easier for Walmart’s executives to predict demand and alter stock levels as necessary. The end result was a reduction in both stockouts and overstock, heightened customer satisfaction, and an uptick in sales.

Real-time Marketing Analytics and Decision Making

Today’s analytics tools make it easier to connect with target audiences and monitor individual stats and metrics ranging from page visits to sales and more.

As an example, Google Analytics, Zoho Analytics, and Klipfolio are easy-to-use cloud-based dashboards with integrated reporting tools for the real-time analysis and integration of data.

Monitor your channels, continue to gauge metric performance, and you’ll identify opportunities for strategic adjustments.

1. Progressive Insurance used marketing analytics to create a mobile app that was as effective as a desktop with the goal of improving customer experience and satisfaction to increase current customer loyalty. Conducting an in-depth analysis using data visualization tools, they were able to track user sessions, demographics, and behaviors.

Tools and resources they benefited from:

-

- Google Analytics 360

- Google Tag Manager 360

- BigQuery

- Three-pronged approach for analyzing:

- User Device Data

- Crash Data

- Log-inSecurity Data

This process allowed them to identify customer pain points and improve the user experience to improve and increase customer loyalty. By improving the log-in process alone, they increased log-ins by an impressive 30%.

321 Web Marketing Has Perfected Analytics for Financial Organizations

At 321 Web Marketing, we accurately measure the true impact of financial organizations’ marketing efforts through strategic analytics. In-depth analysis in real-time pinpoints trends for accurate predictions and timely adjustments.

Are you ready to learn more about marketing analytics for financial organizations? Contact 321 Web Marketing today to find out how our team of experts can help.

We also invite you to share your experiences and insights with marketing analytics below in a mutually beneficial dialogue.